Intent Driven Ad Platform for Digital Marketers

Use our buy-side platform to scale conversions and grow your overall marketing performance by tapping into the largest source of intent based ad formats.

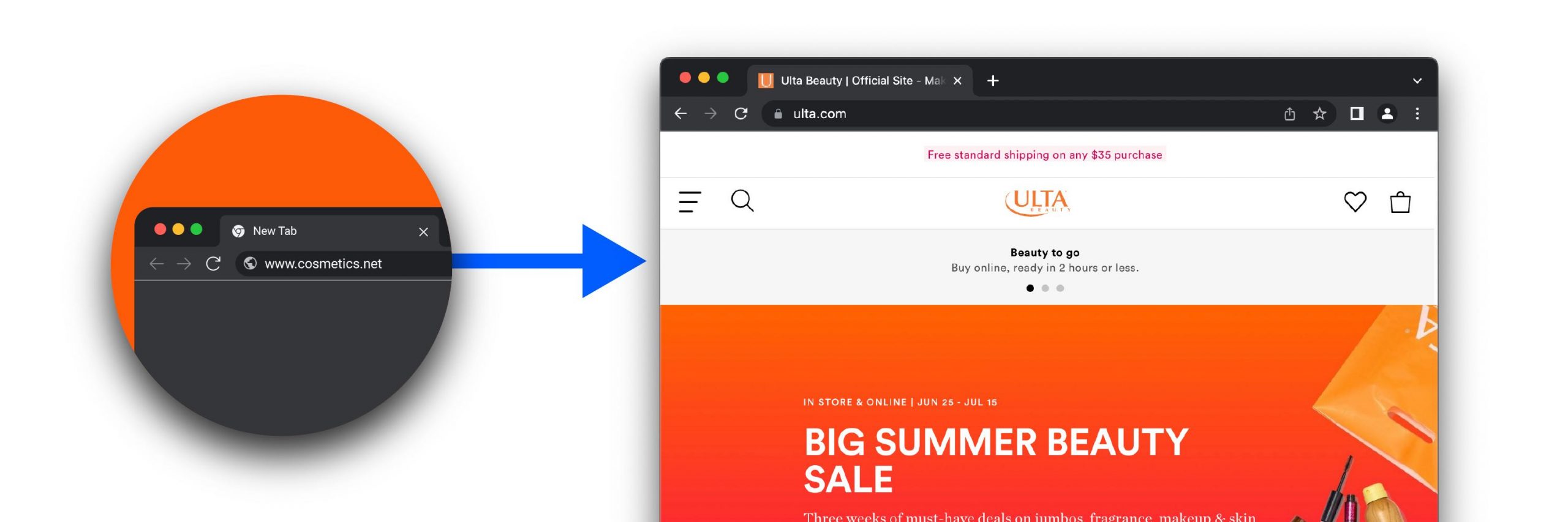

No creative needed

All our formats only require a URL to start receiving traffic.

Simply sign up, choose your campaign format, enter your bid, targeting options and URL and you will start receiving traffic

Why Trillion?

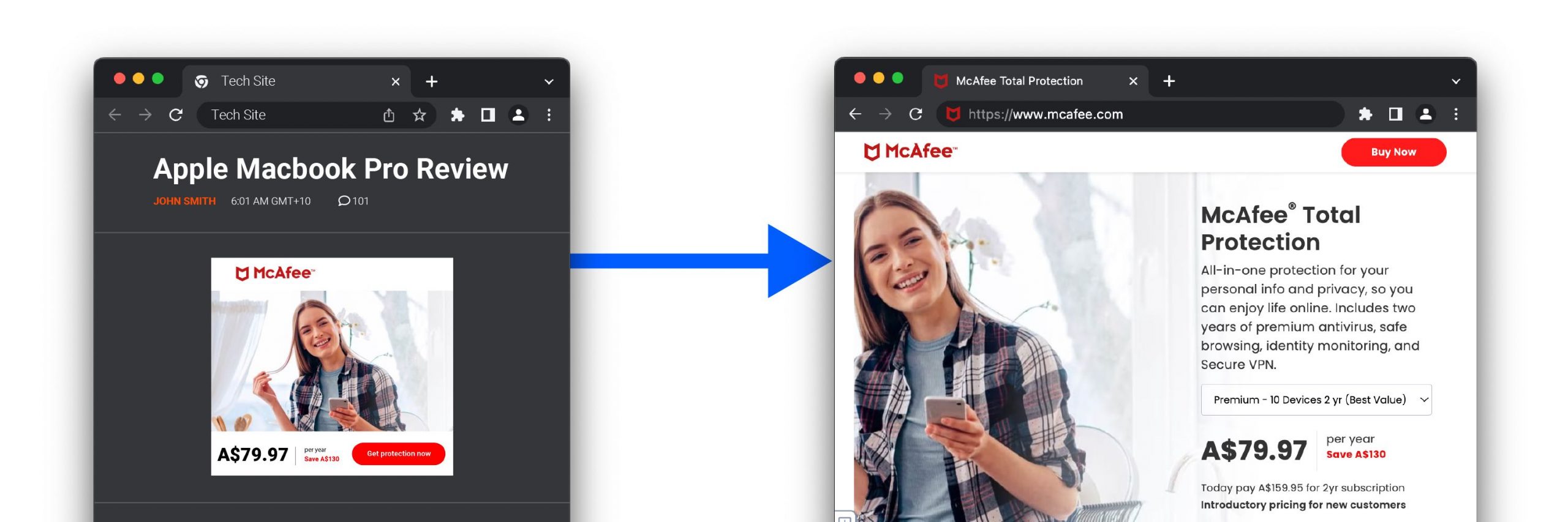

Auction-Based Platform

Our proprietary real-time bidding platform has enabled advertisers to acquire quality intent-based traffic since 2008.

Intuitive Self-Serve Interface

We empower you with easy, full control of bid and budget details, targeting filters, campaign optimization settings, and more.

High Quality Traffic

Our FraudPreventTM technology uses the highest level filtering to ensure that you only receive top quality, brand safe traffic.

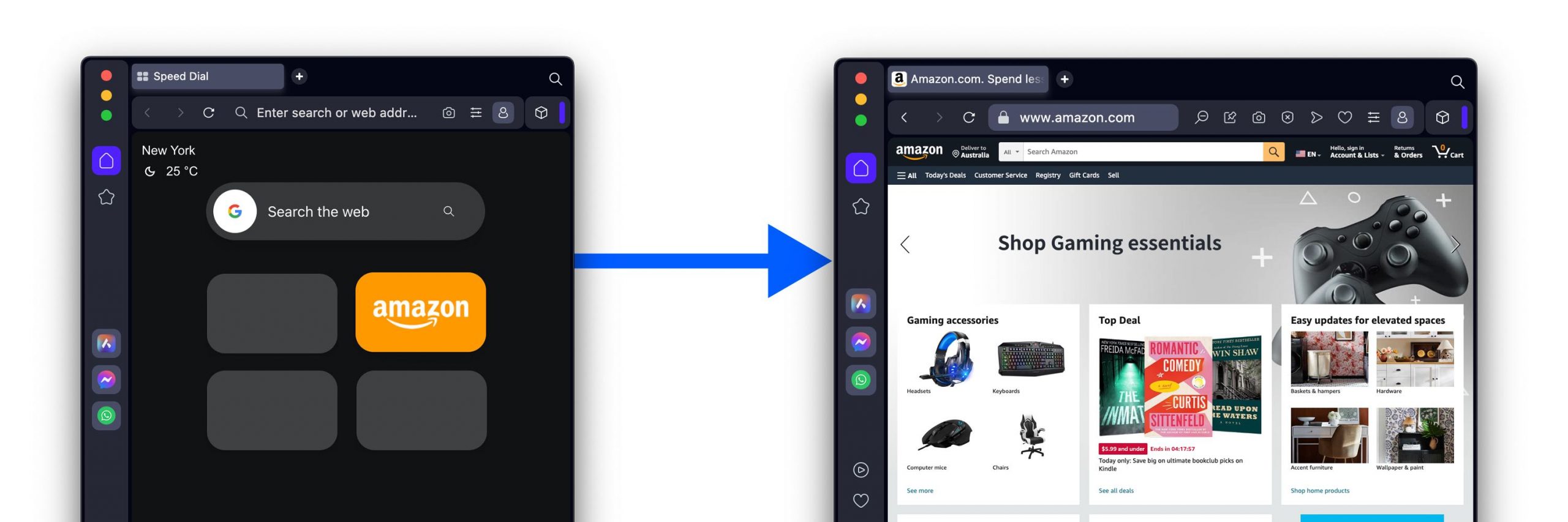

Relevant Keyword Traffic

User intent is carefully researched via our KeyIntentTM process so that only highly relevant traffic is sent to your campaigns.

Detailed Reporting

Quickly and easily get customized online and downloadable statistical reports on campaign performance.

Global Reach

Our global network gives you substantial worldwide opportunities by offering traffic from over 200 countries.

Desktop & Mobile Targeting

Laser target your campaigns and boost conversions with device selection.

ROI Tracking

Our ROI tracking conveniently monitors your campaign performance, conversions and return on investment.

Campaign Optimization

Our tracking tags allow you to enhance campaign performance with blacklisting and whitelisting optimization.

Unmatched customer success

Don’t take our word for it, here’s what our customers have to say.

Trellian's SEO tools have boosted my website's visibility and organic traffic. The keyword research tool is impressive, providing valuable insights. Their customer support is top-notch. Highly recommended for enhancing online presence!

Trellian's SEO tools have boosted my website's visibility and organic traffic. The keyword research tool is impressive, providing valuable insights. Their customer support is top-notch. Highly recommended for enhancing online presence!